What is an ASIC Miner?

Lately, there’s been a lot of talk about Bitcoin and how to get it. Beyond just buying it, some people are looking at the machines that actually make it. These are called ASIC miners. If you’re curious about what these things are, how they work, and if they’re even worth the trouble, you’ve come to the right place. We’re going to break down the whole ASIC miner situation.

Key Takeaways

- An ASIC miner is a specialized computer built just for mining cryptocurrencies like Bitcoin, using Application-Specific Integrated Circuits (ASICs).

- ASICs are designed for one job: hashing. This makes them way faster and more efficient at mining than regular computer parts like CPUs or GPUs.

- The cost of an ASIC miner can vary a lot, depending on its power, efficiency, and the coin it’s made to mine. Newer, more powerful models cost more.

- When you’re thinking about getting an ASIC miner, you need to consider things like how fast it hashes, how much electricity it uses, and how reliable the maker is.

- Making money with an ASIC miner depends on a bunch of things, including electricity costs, the price of the crypto you’re mining, and how hard it is to mine (network difficulty).

Understanding the ASIC Miner

So, you’re looking into cryptocurrency mining and keep hearing about ASIC Miners. What’s the big deal? Basically, an ASIC miner is a specialized piece of hardware built for one thing: mining cryptocurrencies. Think of it like a super-focused tool, unlike your regular computer that can do a million different things. These machines use Application-Specific Integrated Circuits (ASICs), which are chips designed from the ground up to crunch the complex math problems needed to validate transactions and secure the blockchain. This specialized design is why they’re so much more efficient and powerful for mining than your average CPU or GPU. The whole mining game has changed a lot over the years. Back in the day, you could mine Bitcoin with a regular computer. But as more people got into it and the networks grew, mining got harder. This led to better hardware, like FPGAs, but it wasn’t until ASICs came along in the early 2010s that things really took off. Companies like Bitmain and Canaan Creative started making these purpose-built machines, and they quickly became the standard for serious miners. If you’re aiming for profitability, understanding these machines is your first step. Getting the right hardware can make a huge difference in your potential returns, and we’ve got a great selection of miners available at Asic Miners Shop For All.

What is an ASIC Miner?

An ASIC miner is a device that uses Application-Specific Integrated Circuits (ASICs) for the sole purpose of mining digital currency. Unlike general-purpose processors found in everyday computers, ASICs are custom-built to perform a single, specific task – in this case, solving the cryptographic puzzles required for mining. This extreme specialization allows them to perform these calculations much faster and more efficiently than CPUs or GPUs. Each ASIC miner is typically designed to mine a particular cryptocurrency or a set of cryptocurrencies that use similar hashing algorithms. They are essentially highly optimized computers dedicated to generating hashes, which is the core process in proof-of-work mining.

The Evolution of Mining Hardware

Cryptocurrency mining has come a long way from its early days. Initially, mining Bitcoin and other early cryptocurrencies was possible using standard Central Processing Units (CPUs) found in personal computers. As the networks grew and the mining difficulty increased, miners started using Graphics Processing Units (GPUs) because they offered better parallel processing capabilities. This was a significant improvement, but the real game-changer was the introduction of Application-Specific Integrated Circuits (ASICs). The first ASIC miners appeared around 2012-2013, and they represented a massive leap in hashing power and efficiency. These purpose-built machines quickly outcompeted CPUs and GPUs for mining popular cryptocurrencies like Bitcoin, leading to the specialized hardware market we see today. Companies like Bitmain, with their Antminer series, and Canaan Creative, with their Avalon miners, have been at the forefront of this evolution, constantly pushing the boundaries of performance and energy efficiency. This progression highlights the ongoing race for more powerful and efficient mining solutions.

ASIC vs. CPU and GPU Mining

When it comes to mining digital currencies, the hardware you use makes a big difference. Your computer’s CPU (Central Processing Unit) is designed for a wide range of tasks, but it’s not very efficient for the repetitive, complex calculations needed for mining. GPUs (Graphics Processing Units), commonly used for gaming, are better because they can handle many calculations at once. However, ASIC miners are in a league of their own. ASIC stands for Application-Specific Integrated Circuit, and these devices are built with chips that do only mining. This extreme focus means they can perform hashing operations thousands of times faster and with much less wasted energy compared to even the most powerful CPUs or GPUs. For anyone serious about profitability, especially with competitive coins like Bitcoin, an ASIC miner is practically a necessity. While GPUs offer some flexibility for mining different coins, ASICs dominate when it comes to raw hashing power and efficiency for their target algorithms. You can find a variety of powerful ASICs designed for different needs at Asic Miners Shop For All.

How an ASIC Miner Operates

So, you’re wondering exactly how does an ASIC work? It’s pretty straightforward, really. Think of it as a super-specialized computer, built for just one job: mining cryptocurrency. Unlike your regular computer that can do a million things, an ASIC is designed from the ground up to solve the complex math problems needed to validate transactions and secure the blockchain. This focused design is why they’re so much faster and more efficient than using a CPU or GPU for mining.

The Role of Application-Specific Integrated Circuits

At the heart of every ASIC miner is the Application-Specific Integrated Circuit, or ASIC chip. These aren’t your everyday chips; they’re custom-made for a single task – in this case, performing the hashing calculations required for mining. This specialization means they can crunch numbers at speeds that general-purpose processors can only dream of. It’s this very specialization that gives ASIC miners their edge, making them the go-to hardware for serious crypto miners looking to maximize their profits. If you’re serious about mining, understanding the power of these custom chips is key. You can find a wide selection of these powerful machines at places like Asic Miners Shop For All.

The Hashing Process Explained

When you power up an ASIC miner, it connects to a mining pool. This pool then gives the miner a task: find a specific number, called a nonce, that, when combined with transaction data and put through a hashing algorithm, produces a result below a certain target number. It’s like a massive, high-speed lottery where the miner keeps trying different numbers until they hit the jackpot. The more hashes an ASIC can perform per second (its hash rate), the higher its chances of finding that winning number and earning a reward. The speed and efficiency of this hashing process are what determine a miner’s profitability.

Components of an ASIC Miner

An ASIC miner isn’t just a single chip; it’s a complete system designed for mining. Here’s a quick rundown of the main parts:

- ASIC Chips: The brains of the operation, performing the hashing calculations.

- Motherboard: Connects all the components and manages communication.

- Power Supply Unit (PSU): Provides the significant amount of electricity the miner needs to run.

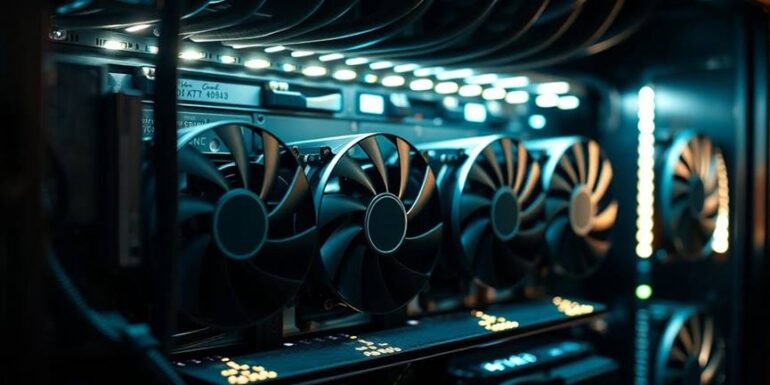

- Cooling System: ASICs generate a lot of heat, so fans or other cooling mechanisms are vital to prevent overheating and maintain performance. Submerging miners in non-conductive oil is one advanced cooling method used.

- Communication Interfaces: Allows the miner to connect to the internet and mining pools.

These components work together in a finely tuned system to achieve the high hash rates necessary for profitable mining. Getting the right setup can make a big difference in your mining journey.

Choosing the right miner is a big step towards financial freedom and understanding how these machines operate is the first part of that journey. Many miners find that joining a mining pool significantly increases their chances of earning rewards, as they can combine their hashing power with others. You can explore different ASIC mining machines to see what fits your strategy.

Key Considerations for ASIC Mining

So, you’re thinking about jumping into the ASIC mining game? That’s awesome. But before you drop a stack of cash on the latest bitcoin mining hardware, let’s talk about what really matters to make sure you’re not just buying a fancy paperweight. It’s all about picking the right tool for the job to actually make some money.

Hash Rate and Performance Metrics

Think of hash rate as the speed of your miner. The higher the TH/s (terahashes per second), the more calculations your machine can churn through. More calculations mean a better shot at finding those blocks and earning rewards. When you’re looking at the best mining machines, you’ll see hash rates listed. Don’t just look at the number, though; consider how it stacks up against the power it uses. A super-fast miner that guzzles electricity might not be as profitable as a slightly slower one that’s more energy-efficient.

Energy Efficiency and Power Consumption

This is where a lot of miners trip up. These machines use a ton of electricity. You absolutely need to figure out your electricity cost per kilowatt-hour (kWh) and compare that to the miner’s power draw (in watts or kilowatts). A miner that’s more energy-efficient will have a lower power consumption for its hash rate. This directly impacts your profit margins. It’s not just about how fast it mines, but how much it costs to keep it running.

You’ll need to check the miner’s wattage and compare it to your electricity rates. A small difference in efficiency can mean thousands of dollars saved or lost over time.

Choosing the Right Cryptocurrency Algorithm

This is super important. ASICs are built for specific algorithms. You can’t just buy any ASIC and expect it to mine any coin. For example, an ASIC designed for Bitcoin’s SHA-256 algorithm won’t mine Litecoin (which uses Scrypt). You need to match the miner’s algorithm to the cryptocurrency you want to mine. This is a big difference compared to gpu vs asic mining, where GPUs are more flexible across different algorithms. Make sure the ASIC you’re eyeing is built for the coin you’re targeting.

Here’s a quick rundown of what to look for:

- Algorithm Compatibility: Does the ASIC support the algorithm of your chosen coin?

- Hash Rate vs. Power: Find the sweet spot for your budget and electricity costs.

- Manufacturer Reputation: Stick with known brands for better reliability and support. You can find reliable power supply solutions for mining rigs from places like Asic Miner Suppliers [5d46].

- Current Market Price: How much does it cost now, and what’s its projected profitability?

Remember, picking the right machine is just the first step. You’ve also got to think about where you’ll put it and how you’ll keep it cool. For instance, the Bitmain Antminer DR5 is a solid choice, but proper ventilation is key to its performance [ebf9].

Acquiring and Maintaining Your ASIC Miner

So, you’re thinking about jumping into the ASIC mining game? That’s awesome. It’s a big step, and getting the right gear is half the battle. When you’re looking to buy, think about what you’re actually getting for your money. The price tag on an ASIC miner can be pretty steep, but it’s not just about the upfront cost. You’ve got to consider the long-term picture to really make it work for your financial freedom goals.

Factors Influencing ASIC Miner Pricing

Prices for these machines aren’t set in stone. They bounce around based on a few things. The miner’s hash rate, which is basically how fast it can crunch numbers for mining, is a big one. Higher hash rates usually mean a higher price. Then there’s energy efficiency – a miner that uses less power for the same amount of work will cost more upfront but save you cash down the line. The specific cryptocurrency algorithm the ASIC is designed for also plays a role; some algorithms are more competitive, driving up demand and prices for the specialized hardware. Newer models with the latest tech will also command a premium. For example, a basic S19 might run you around $540 for about 90 TH/s, while a cutting-edge S21 could be $3,200 for 200 TH/s. It’s a trade-off between initial investment and potential future earnings.

Reliability, Warranty, and Manufacturer Support

When you’re dropping serious cash on a miner, you want to know it’s going to keep running. Look into the manufacturer’s reputation. Are they known for making solid, dependable machines? A good warranty is your best friend here. It can cover you if something goes wrong, saving you from unexpected repair bills. Think about what happens if your miner breaks down – does the company offer good customer service? Are they easy to reach? Having reliable supplies and support from a trusted business is key to keeping your operation humming along without constant headaches. It’s worth checking out places like Asic Miners Shop For All that have been around since 2016 and focus on customer support.

Optimal Operating Conditions and Lifespan

These machines work hard, and they need the right environment to do their best. ASICs generate a lot of heat, so good cooling is non-negotiable. We’re talking about keeping them in a place with good airflow, maybe even a dedicated space with proper ventilation or air conditioning. Dust is also a problem; it can clog up fans and cause overheating. So, keeping your mining setup clean is important. If you treat your ASIC right – keep it cool, clean, and powered steadily – you can expect it to last anywhere from five to seven years. However, technology moves fast. A new, super-efficient model could come out next year, making your current miner less profitable, even if it’s still working perfectly. It’s a bit like buying a new phone; it’s great now, but you know a better one is always around the corner.

The Profitability of ASIC Mining

So, you’re thinking about getting into ASIC mining, huh? It’s not just about buying a fancy box; it’s about making money, plain and simple. The whole point is to boost your financial freedom, and these machines are designed to do just that. Owning an ASIC miner means you’re investing in the infrastructure that generates cryptocurrency, rather than just buying it on the market. It’s a different way to approach your crypto portfolio, and for many, it’s proving to be a solid move. Think of it as owning a small piece of the digital gold rush. You’re not just speculating; you’re actively participating in the network’s security and growth, and getting rewarded for it. It’s a tangible way to earn digital assets, and with the right setup, it can be quite rewarding.

Calculating Return on Investment

When you’re looking at crypto mining profitability, the first thing you need to figure out is your return on investment, or ROI. This isn’t rocket science, but it does take some careful number crunching. You’ve got your initial cost for the ASIC miner itself, which can be a pretty big chunk of change. Then there’s the electricity bill – these things can be power hungry. You also need to factor in the cost of internet, and any pool fees you might pay. On the flip side, you’ve got the cryptocurrency you’re mining. The price of that coin fluctuates, and that’s a huge factor. The difficulty of the network also plays a big role; the harder it is to mine, the less you’ll earn per unit of power. It’s a balancing act, for sure. You want to find that sweet spot where your earnings consistently outpace your expenses.

Impact of Electricity Costs

Let’s be real, electricity is probably the biggest ongoing expense you’ll have with an ASIC miner. If you’re paying top dollar for power, it can eat into your profits pretty quickly. That’s why people look for cheaper electricity rates, maybe in areas where renewable energy is abundant and less expensive. For example, some operations might take advantage of excess wind power in places like Iowa, which can significantly lower operating costs. It’s not just about the price per kilowatt-hour, though; it’s also about how efficiently your miner uses that power. A more energy-efficient miner will always be better for your bottom line, even if it costs a bit more upfront. You’re essentially buying future savings with that efficiency.

Navigating Network Difficulty and Rewards

This is where things can get a little tricky, but it’s super important for understanding profitability. The network difficulty is basically a measure of how hard it is to find a new block and earn a reward. As more miners join the network, or as the hardware gets more powerful, the difficulty goes up. This means your miner has to work harder to find those blocks. The rewards themselves can also change. For some cryptocurrencies, like Bitcoin, there’s a programmed halving event where the block reward is cut in half roughly every four years. This directly impacts how much you earn over time. So, you’re not just looking at today’s earnings; you’re thinking about how these factors will play out over the lifespan of your miner. It’s a dynamic environment, and staying informed is key. You can find some of the best ASIC miners for sale to help maximize your returns here.

ASIC Miner Deployment Strategies

So, you’ve got your ASIC miner, or you’re thinking about getting one. That’s great! But just having the machine isn’t the whole story. You need to figure out where to put it and how to keep it running smoothly so you can actually make some money. It’s not like plugging in a toaster, you know?

Selecting a Mining Pool

Think of a mining pool as a team for miners. Instead of trying to solve those super hard math problems all by yourself, you team up with others. When the team solves a problem, everyone gets a piece of the reward based on how much work they did. It really helps smooth out your income, because sometimes you might go ages without finding a block on your own. Joining a pool means you get paid more regularly, even if the amounts are smaller each time. You’ll want to look at different pools and see which ones have the best reputation, what fees they charge, and how often they pay out. Some pools are better for certain types of miners or cryptocurrencies, so do a little homework.

Location and Cooling Requirements

Where you put your miner matters a lot. These things get hot, like, really hot. If you don’t cool them properly, they can break down or just not work as well, which kills your profits. You need a place with good airflow, or even better, a dedicated cooling system. Some people use immersion cooling, where the machines sit in a special liquid. It sounds fancy, but it’s super effective at keeping things chill. You also need to think about noise. ASICs can be loud, so your garage might be okay, but your living room probably isn’t. Also, consider shipping your miner to a specialized hosting facility if you don’t have the right setup at home. Many companies offer these services, taking care of power and cooling for a fee. It can be a good way to get started without a huge upfront investment in infrastructure.

Upgrading Electrical Infrastructure

These machines suck up a lot of power. Seriously, a lot. You can’t just plug a few into a standard wall outlet and expect them to run without issues. You might need to upgrade your home’s electrical panel or even get a dedicated circuit installed. If you’re planning on running multiple miners, this becomes even more important. Ignoring your electrical setup is a fast track to tripping breakers or worse, causing a fire. It’s best to consult with an electrician to make sure your setup can handle the load safely. This is a cost you absolutely need to factor in when you’re planning your mining operation. Getting the right power supply and wiring is key to keeping your miners running 24/7 without interruption. It’s all about setting yourself up for consistent production and, ultimately, better financial freedom.

When setting up your ASIC miners, think about the best ways to make them work for you. It’s not just about plugging them in; it’s about planning for success. Want to learn more about how to get the most out of your mining machines? Check out our website for expert tips and the latest gear.

So, What’s the Verdict on ASIC Miners?

Alright, so we’ve talked about what ASIC miners are, how they work, and why they’ve become the go-to for serious crypto mining, especially for Bitcoin. These specialized machines are built for one thing: hashing. They’re way faster and more efficient than your average computer for this job. Think of them as super-focused tools. While they can be a big upfront investment, and you’ve got to consider things like electricity costs, noise, and heat, they’re designed to keep churning out those hashes. Companies like Bitmain with their Antminers have really pushed the technology forward, making mining more accessible, though still complex. If you’re looking to get into mining, understanding these machines is key. They’re not just toys; they’re the engines driving a significant part of the crypto world.

Frequently Asked Questions

What exactly is an ASIC miner?

An ASIC miner is a super specialized computer built just for mining cryptocurrencies like Bitcoin. Unlike regular computers that can do many things, ASICs are designed to do one job really well: solving the tough math problems needed to secure the blockchain and earn rewards.

Why are ASICs better than CPUs or GPUs for mining?

ASICs are much, much faster at mining than regular computer parts like CPUs (the brain of your computer) or GPUs (the graphics cards). Think of it like using a race car built only for the track instead of a regular car that can drive anywhere. This speed is key to earning crypto.

How much does an ASIC miner usually cost?

The cost can change a lot! A basic ASIC might cost a few hundred dollars, but the newer, more powerful ones can cost thousands. The price depends on how fast it is, how much power it uses, and how much people want them.

Do ASIC miners use a lot of electricity?

Yes, they do! ASIC miners use a lot of electricity because they’re working so hard. This means your electric bill will go up, and you need to make sure your home’s electrical system can handle the extra power. It’s important to figure out if the cost of electricity will let you make a profit.

How long will an ASIC miner last?

An ASIC miner can last about 5 to 7 years if you take good care of it. This means keeping it cool, clean, and protected from power spikes. However, new technology comes out all the time, so sometimes older ASICs might not be profitable anymore even if they still work.

How do I know if ASIC mining will be profitable for me?

To make money, you need to consider how much you pay for electricity, the price of the cryptocurrency you’re mining, and the cost of the ASIC itself. You also need to think about how difficult it is to mine the coin and how many rewards you get. It’s like running a business – you have to balance your costs with your earnings.