Mining Power: What You Need to Know

Thinking about getting into crypto mining? It can sound like a good way to earn some digital coins, but it’s not as simple as it looks. Lots of people get confused by all the technical terms and the fast changes in the tech. We’ll break down what you really need to know, from the machines you use to how much power they chew through. Understanding the basics, especially the importance of a reliable power supply for mining, is key to figuring out if it’s even worth it for you.

Key Takeaways

-

ASIC machines are now the main way most Bitcoin is mined because they’re much faster and more efficient than older methods like using CPUs or GPUs.

-

The cost of electricity is a big deal for mining profitability, so finding ways to be energy efficient is important.

-

Joining a mining pool helps increase your chances of earning rewards by combining your computer’s power with others.

-

Mining difficulty has gone up a lot over the years, making it harder for individuals to mine profitably without specialized gear.

-

You need to consider hardware costs, electricity expenses, and the specific cryptocurrency’s difficulty to see if mining makes financial sense.

Understanding Mining Hardware

When you’re looking to get into cryptocurrency mining, the hardware you choose is a pretty big deal. It’s not like picking out a new graphics card for gaming; this is about serious computational power aimed at profitability. The right hardware can make the difference between earning a steady income and just burning electricity.

The Rise of ASICs in Bitcoin Mining

Back in the day, you could mine Bitcoin with a regular computer’s CPU. Those times are long gone. Now, the game is dominated by ASICs, which stands for Application-Specific Integrated Circuits. These machines are built for one thing and one thing only: mining specific cryptocurrencies. Because they’re so specialized, they’re way more efficient and powerful than general-purpose hardware like GPUs. If you’re serious about Bitcoin, you’ll likely need to look into ASIC mining machines. They cost a pretty penny, often thousands of dollars, but their hashing power is unmatched. Think of it like using a specialized tool versus a Swiss Army knife – for mining, ASICs are the specialized tool.

Graphics Processing Units for Mining

While ASICs rule Bitcoin, GPUs (graphics cards) still have a place, especially for other cryptocurrencies. They were the next step up from CPUs, offering much better performance. Even today, some miners use GPU rigs, especially if they’re mining altcoins or want more flexibility. A good GPU can set you back a grand or two, and you’ll need several for a decent mining setup. They consume a lot of power, and keeping them cool is a whole other challenge. It’s a step up from CPUs, but not quite the specialized power of ASICs for major coins.

Hardware Costs and Performance

Let’s talk numbers. The cost of mining hardware can be intimidating. You’ve got your entry-level GPUs starting around $1,000, going up to $2,000 or more for high-end models. Then you have ASICs, which can easily run into the tens of thousands of dollars. But it’s not just about the sticker price; it’s about performance. More expensive hardware usually means a higher hash rate, which is how many calculations your machine can perform per second. A higher hash rate means a better chance of earning rewards. However, you have to balance this against electricity costs and the overall profitability of the coin you’re mining. It’s a constant calculation to see if the investment makes financial sense.

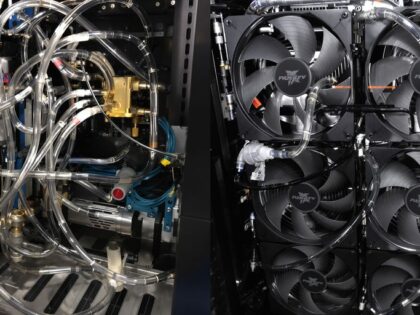

The Role of Power Supply for Mining

When you’re setting up a mining operation, whether it’s a few graphics cards or a full-blown ASIC farm, the power supply unit (PSU) is probably one of the most overlooked, yet critical, components. It’s not just about getting enough watts; it’s about efficiency, reliability, and making sure your expensive hardware doesn’t fry. Think of it as the heart of your mining rig – if it falters, everything stops. Getting the best PSU for crypto mining is a direct investment in your profitability and the longevity of your equipment.

Electricity Consumption in Mining Operations

Mining rigs, especially ASICs and multiple GPUs, are power-hungry beasts. They run 24/7, and that constant draw adds up fast on your electricity bill. Understanding your mining rig power requirements is the first step. You need to calculate the total wattage your mining hardware will consume and then add a buffer. A good rule of thumb is to choose a PSU that can handle at least 20% more wattage than your rig’s maximum draw. This prevents the PSU from running at its absolute limit, which reduces heat, improves efficiency, and extends its lifespan. For example, a rig with two GPUs that each draw 300W and a motherboard/CPU combo drawing 150W would need a PSU capable of at least 750W (2*300 + 150 = 750W), but aiming for a 900W or 1000W unit would be much safer and more efficient.

Impact of Power Costs on Profitability

Your electricity cost is a major factor in whether mining is profitable. If your electricity is expensive, even a powerful rig might not make you money. This is where efficient power supply for GPUs and ASICs really shines. A more efficient PSU wastes less electricity as heat, meaning more of the power drawn from the wall actually goes to your mining hardware. This directly translates to lower electricity bills and higher profits. It’s not uncommon for electricity to be the single largest operating expense in mining, so optimizing this is key to financial freedom.

Choosing a PSU with a high efficiency rating, like 80 Plus Gold or Platinum, can make a significant difference in your monthly expenses. While these PSUs might cost a bit more upfront, the savings on electricity over time usually make them the more economical choice for serious miners.

Energy Efficiency of Mining Rigs

When you’re looking at choosing a mining PSU, pay close attention to its efficiency rating. This is usually displayed as an 80 Plus certification (Bronze, Silver, Gold, Platinum, Titanium). A PSU rated 80 Plus Gold, for instance, is at least 87-90% efficient at typical loads. This means that for every 100 watts it pulls from the wall, 87-90 watts are delivered to your components, and the rest is lost as heat. For ASICs, efficiency is often measured in Joules per Terahash (J/TH). Lower J/TH means better efficiency. A high wattage power supply for ASICs that is also highly efficient will be your best bet for maximizing returns. It’s a balancing act between the initial purchase price of the PSU and its ongoing operational cost. Remember, the goal is to maximize your hash rate while minimizing your electricity consumption. You can compare different mining pools based on their reliability and profitability at CryptoCompare.

Here’s a quick look at how efficiency impacts power draw:

|

PSU Efficiency |

Power Drawn for 1000W Output |

Heat Wasted |

|---|---|---|

|

80% |

1250W |

250W |

|

90% |

~1111W |

~111W |

|

94% |

~1064W |

~64W |

As you can see, a small increase in efficiency can lead to a substantial reduction in wasted energy and heat. This is why investing in a quality, efficient PSU is so important for any mining setup, whether you’re using GPUs or ASICs. If you’re looking to get started with ASIC mining, understanding the specific power needs of your chosen miner is paramount, as detailed in resources like this guide. When purchasing ASIC miners, it’s also important to consider their energy efficiency, measured in Joules per Terahash (J/TH), as lower numbers indicate better performance and long-term profitability, as explained by FoundyUSA.

Mining Pools and Network Participation

When you’re looking to get into crypto mining, especially if you’re aiming for consistent profits and a path to financial freedom, joining a mining pool is pretty much a no-brainer. Think of it like this: instead of trying to win the lottery by yourself, you’re pooling your tickets with a bunch of other people. This way, when someone wins, everyone gets a piece of the prize, making those payouts much more predictable. It really smooths out the income stream, which is super important when you’re trying to cover the costs of hardware like the Bitmain Antminer S19 XP and your electricity bill.

How Mining Pools Enhance Success Rates

Solo mining, especially for major cryptocurrencies like Bitcoin, is incredibly tough. The network’s hash rate is massive, meaning your individual machine’s power is just a tiny drop in a huge ocean. Without a pool, your chances of finding a block and earning a reward are astronomically low. You could spend a fortune on hardware and electricity and never see a single coin. Mining pools solve this by combining the hashing power of many miners. This collective power significantly increases the probability of finding blocks. When the pool finds a block, the reward is shared among all participants based on the amount of work, or ‘shares,’ each contributed. This makes mining a much more reliable way to earn, even if your individual contribution is small. It’s all about consistent, albeit smaller, rewards rather than a rare, big win.

Distributing Rewards in Mining Pools

Different pools use various reward systems, but most operate on a ‘pay-per-share’ (PPS) or ‘full-pay-per-share’ (FPPS) model. In PPS, you get paid for every valid share you submit, regardless of whether the pool actually finds a block. FPPS is similar but also includes a portion of the transaction fees. Other systems, like ‘proportion’ or ‘score-based’ methods, distribute rewards based on how many shares you’ve submitted over time. It’s important to understand these systems because they directly impact your earnings. Some pools might have higher fees but offer more stable payouts, while others might have lower fees but more variability. You’re essentially buying into a more predictable income stream, which is key for planning your mining operation and ensuring profitability.

Choosing a Reliable Mining Pool

Picking the right pool is as important as picking the right hardware. You want a pool that’s stable, has a good reputation, and offers transparent reward distribution. Look for pools with a low fee structure, but don’t let that be the only factor. Check their uptime history and read reviews from other miners. Some pools are better suited for specific coins or hardware. For instance, if you’re running powerful ASICs, you’ll want a pool that supports those machines and has a large enough hash rate to be competitive. It’s also a good idea to check out pools that are actively maintained and have good customer support, just in case you run into any issues. Finding a good pool can make a big difference in your overall mining success and profitability, helping you get closer to your financial goals.

Joining a mining pool is a strategic move for any miner serious about consistent returns and managing the inherent risks of cryptocurrency mining. It transforms mining from a game of chance into a more predictable business venture, making it easier to calculate potential profits and plan for the future. This collaborative approach is what makes mining accessible and sustainable for individuals looking to participate in the digital asset economy.

When you’re ready to get your mining operation set up, make sure you’re looking at reliable hardware suppliers. Getting your equipment shipped and set up correctly is the first step to joining a pool and starting to earn. Remember, the goal is consistent income, and pools are a major part of achieving that.

The Evolution of Cryptocurrency Mining

When cryptocurrency first popped up, mining was pretty straightforward. You could actually use a regular computer’s CPU to mine things like Bitcoin. It was like the wild west – anyone with a decent PC could jump in and potentially earn some coins. Those early days were simpler, and the barrier to entry was low. But as more people got involved and the value of these digital assets climbed, things got competitive, fast.

From CPUs to Specialized Hardware

That initial CPU mining phase didn’t last long. The math problems that miners had to solve got harder and harder. It became clear that CPUs just weren’t cutting it anymore. This led to the next big shift: Graphics Processing Units, or GPUs. You know, the fancy graphics cards people use for gaming? Turns out, they’re way better at crunching the numbers needed for mining. This caused a huge surge in demand for GPUs, sometimes making them hard to find and driving up prices for everyone, including gamers. If you were looking to get into mining back then, you’d need to think about building a rig with multiple GPUs. It was a step up in complexity and cost, but the potential rewards were higher. This era really showed how quickly the mining landscape could change, pushing miners to constantly seek out more powerful hardware to stay competitive. It’s a cycle that continues today, with miners always looking for the next best thing to maximize their hash rate and profitability. You can find more about the history of Bitcoin and its early days on Freeman Law’s Blockchain and Cryptocurrency Resource Page.

The Impact of Increased Mining Difficulty

As more miners joined the network and used more powerful hardware, the overall difficulty of mining increased. Think of it like a race where everyone suddenly gets faster cars – the finish line moves further away for everyone. This meant that even with better equipment, earning rewards became tougher. The network automatically adjusts the difficulty to keep block creation times consistent, but for individual miners, it meant needing even more processing power to have a decent chance of success. This constant escalation in difficulty is a major reason why specialized hardware, like ASICs (Application-Specific Integrated Circuits), became dominant. ASICs are built from the ground up for one purpose: mining a specific cryptocurrency. They are incredibly efficient but also very expensive and quickly become obsolete as newer, more powerful models are released. This arms race for processing power is a defining characteristic of modern cryptocurrency mining.

GPU Mining’s Past and Present

GPU mining really took off after CPU mining became impractical. For a while, it was the go-to method for many miners, offering a good balance between performance and accessibility compared to the even more specialized ASICs that would later emerge. Miners would assemble rigs with multiple GPUs, all working together to solve cryptographic puzzles. This period saw significant growth in the mining community, but also led to shortages and price hikes for graphics cards, impacting the gaming industry. Today, while ASICs dominate for major cryptocurrencies like Bitcoin, GPUs still play a role in mining other altcoins. The landscape is always shifting, though. Some newer cryptocurrencies are designed to be more resistant to ASIC mining, making GPU mining relevant again for certain digital assets. It’s a dynamic field where hardware choices depend heavily on the specific cryptocurrency you’re targeting and the current state of the network difficulty.

The drive for more efficient and powerful mining hardware is relentless. What was cutting-edge a few years ago is often outdated today, forcing miners to constantly evaluate their equipment and strategies to maintain profitability in a rapidly evolving market.

Key Concepts in Mining Operations

Understanding the core mechanics of cryptocurrency mining is key to making smart decisions, especially if you’re aiming for profitability and financial freedom. It’s not just about buying the latest hardware; it’s about knowing what makes the whole system tick. Think of it like understanding how a mine works before you start digging for gold. You need to know the tools, the process, and the risks involved.

Hashing Power and Network Speed

When we talk about mining, hashing power is a big deal. It’s basically the speed at which your mining hardware can perform calculations. The more hashing power you have, the more attempts you can make to solve the complex math problems that secure the blockchain and earn you rewards. This is often measured in hashes per second (H/s), kilohashes per second (kH/s), megahashes per second (MH/s), gigahashes per second (GH/s), terahashes per second (TH/s), and even petahashes per second (PH/s) for the most powerful machines. Higher hashing power directly translates to a better chance of finding a block and earning rewards. It’s a bit like having more tickets in a lottery – the more you have, the better your odds. When you’re looking at powerful machines like the Bitmain Antminer S21e XP Hyd 3U, its 860 TH/s hash rate is a significant factor in its earning potential.

Proof of Work Explained

Most major cryptocurrencies, including Bitcoin, use a system called Proof of Work (PoW) to validate transactions and create new coins. Here’s the simple version: miners use their specialized hardware to solve a very difficult mathematical puzzle. The first miner to solve it gets to add the next block of verified transactions to the blockchain and is rewarded with new cryptocurrency. This process requires a lot of computational power, which is why efficient hardware and electricity are so important. It’s a competitive process, and the difficulty of the puzzle adjusts over time to keep block creation at a steady rate. This competition is what drives the need for increasingly powerful and efficient mining equipment.

Understanding Mining Terminology

Getting a handle on the lingo is pretty important. You’ll hear terms like:

-

Block: A collection of verified transactions that gets added to the blockchain.

-

Hash: The output of a hashing algorithm, essentially a unique digital fingerprint for a block of data.

-

Nonce: A random number that miners change to try and find a valid hash for a block.

-

Difficulty: A measure of how hard it is to find a valid hash. It increases as more miners join the network.

-

Block Reward: The amount of cryptocurrency a miner receives for successfully mining a block. This is a primary incentive for mining.

Knowing these terms helps you understand mining profitability calculators and discussions about network performance. It’s also helpful when researching where to buy your mining equipment, as reputable dealers will often use this terminology to describe their products. For instance, understanding hash rate and power consumption helps you compare different ASICs to maximize crypto mining returns.

Mining isn’t just about solving puzzles; it’s a race where efficiency and raw power determine your success. The better you understand these concepts, the more likely you are to make profitable decisions and achieve your financial goals. It’s about making informed choices, from the hardware you purchase to the electricity you use. Remember, the goal is to extract value, much like traditional mining extracts minerals from the earth.

Navigating the Mining Landscape

So, you’re thinking about getting into crypto mining, huh? It’s not quite as simple as just plugging in a machine and waiting for coins to appear. You’ve got to figure out if it’s actually going to make you money, and that’s where things get interesting. Profitability is the name of the game, and understanding the factors that influence it is key to not just breaking even, but actually seeing some financial freedom.

Assessing Mining Profitability

When you’re looking at mining, the first thing you need to do is crunch the numbers. It’s all about comparing your expected income against your costs. Your main expenses will be electricity, hardware, and pool fees. The income side depends on the cryptocurrency’s price, the network’s difficulty, and your rig’s hashing power. It’s a constant balancing act.

Here’s a quick look at what goes into the calculation:

-

Electricity Costs: This is often the biggest ongoing expense. Check your local rates carefully.

-

Hardware Investment: How much did your ASICs or GPUs cost? Factor in their lifespan.

-

Mining Difficulty: This changes based on how many miners are on the network. More miners mean higher difficulty and less reward per miner.

-

Cryptocurrency Price: Obviously, if the coin you’re mining goes up in value, your profits increase.

-

Pool Fees: Most miners join pools, which take a small percentage of your earnings.

Using a crypto mining calculator can really help here. You plug in your hardware specs, electricity cost, and the current network data, and it gives you an estimate of your daily or monthly profit. It’s a good way to see if a particular coin or setup makes sense before you commit.

Risks and Volatility in Mining

Now, let’s talk about the not-so-fun stuff: the risks. The crypto market is known for its wild swings. One day your mining operation could be highly profitable, and the next, a price crash could wipe out your gains. This volatility means you can’t just set it and forget it; you need to stay informed.

The dream of financial freedom through mining is real, but it’s built on a foundation of careful planning and risk management. Don’t bet the farm on it; start small and scale up as you learn.

Think about it like this: if you invest $5,000 in mining hardware, and the price of the coin you’re mining drops by 50%, your investment’s value is cut in half, and your mining income also shrinks. You also have to consider the possibility of hardware failure or changes in regulations. It’s important to have a strategy for dealing with these ups and downs. Some miners diversify by mining different coins or investing in companies that mine, like Hut 8 or MARA Holdings, though these stocks can be just as unpredictable MARA Holdings.

Legal and Regulatory Considerations

This is a big one, and it’s often overlooked. Mining laws and regulations can vary a lot depending on where you live. Some places are very crypto-friendly, while others have strict rules or even outright bans. It’s your responsibility to know the laws in your area. This includes understanding how mining income is taxed and if there are any specific permits or licenses required for operating mining equipment, especially if you’re running a larger operation. Staying compliant is just as important as keeping your machines running efficiently. You don’t want to get hit with unexpected fines or legal trouble down the line. Checking out state-by-state resources on digital currency laws can be a good starting point.

Exploring the world of mining can be tricky, but we’re here to help you understand it better. From finding the right resources to making smart choices, we break down the complex parts of the mining industry into easy-to-grasp ideas. Want to learn more about how to succeed in this field? Visit our website today for all the tips and guides you need!

Wrapping Up Your Mining Journey

So, after all that, what’s the takeaway? Mining crypto, especially Bitcoin, isn’t like it used to be. Back in the day, your home computer might have done the trick, but now? It’s a whole different ballgame. You’re looking at specialized machines, often called ASICs, that cost a pretty penny and use a ton of electricity. Plus, you’ve got to think about cooling and the actual cost of power in your area. Joining a mining pool is pretty much a must if you want any real shot at earning rewards, as going solo is like playing the lottery with really long odds. Keep in mind that the price of the crypto you’re mining can swing wildly, affecting your profits. And don’t forget about taxes – that’s a whole other can of worms. While it’s still possible to mine, it’s definitely not as simple as it once was, and you’ll need to do your homework to see if it makes sense for you.

Frequently Asked Questions

What exactly is cryptocurrency mining?

Think of mining like a digital treasure hunt. Miners use special computers to solve really hard math problems. Whoever solves the problem first gets to add the latest transactions to the blockchain (a digital record book) and is rewarded with new cryptocurrency, like Bitcoin. It’s how new coins are made and how transactions are kept safe.

What kind of equipment do I need to mine crypto?

In the old days, you could mine with a regular computer. But now, the math problems are super tough! Most people use special machines called ASICs, which are like super-miners made just for this. Some people also use powerful graphics cards (GPUs) from gaming computers. These machines need a lot of electricity and can be quite expensive.

Why does crypto mining use so much electricity?

Mining uses a lot of electricity because those special computers work really hard, 24/7. This means your electricity bill can get pretty high. The cost of electricity is a big deal because it affects how much money you can make from mining.

What are mining pools and why should I join one?

Mining by yourself is like trying to win the lottery – your chances are very slim. Mining pools are groups of miners who combine their computer power. When the group solves a problem, they share the reward. It’s like working together on a big project; you’re more likely to get paid, and you share the earnings based on how much you helped.

What does ‘mining difficulty’ mean?

The difficulty of mining goes up as more miners join. It’s like if more people are trying to solve the same puzzle, it gets harder for everyone. So, even with better machines, it can take longer to find a solution and earn rewards.

What are the risks involved in crypto mining?

Mining can be risky! The price of cryptocurrencies like Bitcoin can change a lot, very quickly. This means the money you earn from mining might not be worth as much tomorrow. Also, there are rules and laws about mining in different places, so it’s smart to check what’s allowed where you live.