Finding Your ASIC Miner Supplier

So, you’re looking to get into ASIC mining, huh? It can be a bit of a maze trying to figure out who to buy from. There are big names, smaller companies, and a whole lot of details to consider before you hand over your cash. This guide is here to break down what you need to know to find a good asic miner supplier.

Key Takeaways

-

Bitmain and MicroBT are the main ASIC manufacturers, but other companies are also making miners.

-

When buying used ASICs, always check for a hash report and be aware that warranties might be void.

-

Understand lead times and consider if spot or future orders work best for your needs.

-

ASIC prices don’t always move with Bitcoin prices, especially after halving events.

-

Look for suppliers with experience, good customer service, and a focus on volume over high margins.

Understanding ASIC Miner Manufacturers

When you’re looking to get into crypto mining, figuring out who actually makes the machines is a big first step. It’s not like picking up a toaster; these are specialized pieces of tech, and knowing the manufacturers helps you understand what you’re buying. If you want to find out where to buy ASIC miners, you first need to know who’s building the best ASIC mining hardware.

Dominant Players in the ASIC Market

Right now, a few big names really run the show when it comes to ASIC miners. Bitmain is probably the one you hear about the most. They make the Antminer series, and honestly, they’ve got a huge chunk of the market, something like 75%. People like them because their machines are generally powerful and efficient for mining Bitcoin. Then you have MicroBT, who makes Whatsminers, holding about 18% of the market. Canaan, with their Avalon miners, is the third biggest player. It’s interesting that all these major companies got their start in China, though some are expanding their production to other parts of Asia and even the US.

Emerging ASIC Manufacturers

While the big three are well-established, there are always new companies trying to break in. For example, Auradine, based in Silicon Valley, has introduced their TeraFlux miners. These have a feature called EnergyTune that lets you adjust power and hashrate on the fly without needing to restart the machine. It’s a neat trick for managing power usage. Another company, DesiweMiner, was bought by Bitdeer, and they’re now working together on a miner called the SEALMINER. It’s good to keep an eye on these newer companies; sometimes they bring fresh ideas to the table that can really shake things up in the market.

Geographic Origins and Production

Most of the big ASIC manufacturers, like Bitmain and MicroBT, are originally from China. That’s where a lot of the manufacturing happens, but they also have production facilities in other Asian countries. MicroBT is one of the companies that also does some assembly in the United States, which can sometimes affect shipping times and logistics for buyers in North America. Understanding where your equipment is coming from can be helpful when you’re trying to figure out shipping and potential import duties. It’s a global business, for sure, and knowing the supply chain helps when you’re looking for reliable crypto mining equipment vendors.

When you’re comparing different ASIC miners, always look at the specs like hashrate (how fast it computes), power consumption (how much electricity it uses), and efficiency (how much power it takes to compute one hash). These numbers are key to figuring out how profitable a machine will be over time. A machine that’s more efficient will cost less to run, which means more of the mined crypto is pure profit.

It’s worth noting that the specs you see on paper might not always match reality perfectly. Manufacturers test their machines in ideal conditions. Things like higher ambient temperatures can mean a miner uses more power than advertised to keep up. So, while specs are important, it’s also good to be aware of how real-world conditions can affect performance. This is why choosing a good supplier, perhaps one of the established ASIC miner distributors, can be so helpful; they often have insights into how different models perform outside the lab. For instance, the Bitmain Antminer S19 Pro is a popular choice, known for its strong performance.

Evaluating ASIC Miner Condition and Warranty

When you’re looking to buy ASIC miners, whether they’re brand new or pre-owned, checking their condition and understanding the warranty is super important for your bottom line. It’s not just about getting the machine; it’s about making sure it’ll actually perform and keep performing without costing you a fortune in repairs.

Assessing Used ASIC Miners

Buying used ASICs can be a smart way to save some cash upfront, but you’ve got to be careful. Always ask for a recent hash report before you commit. This report should show the miner’s current hash rate (TH/s) and its power consumption. Why? Because used machines can have hidden problems. Think about things like fans that are about to give out, chips that aren’t performing at their best, or even a whole hashboard that’s gone bad. Any of these issues can seriously cut into the machine’s output and your potential profits. It’s like buying a used car; you want to know its history and current state.

Understanding New Unit Warranties

Most manufacturers offer a standard 12-month warranty on new units. This gives you a safety net if something goes wrong early on. It covers defects in manufacturing, which is pretty standard. However, if you’re looking at a used miner that’s already a year old or more, that factory warranty is likely long gone. So, you’re taking on more risk with older, out-of-warranty equipment. It’s a trade-off between initial cost and future security.

Impact of Modifications on Warranties

This is a big one: messing with the miner’s original setup can instantly void your warranty. This includes things like trying to flash custom firmware, swapping out parts like the control board, or even something as seemingly minor as changing the cooling system without authorization. For example, if you decide to try immersion cooling on an air-cooled unit and something fries, don’t expect the manufacturer to cover it. Always stick to the manufacturer’s guidelines or consult with them directly before making any changes to your ASIC mining hardware.

Key Considerations for ASIC Miner Procurement

When you’re looking to get your hands on ASIC miners, there are a few big things to think about that can really make or break your operation. It’s not just about picking the shiniest new machine; it’s about timing, how you buy, and what you do to keep it running cool. Getting these details right means more profit in your pocket and less hassle overall.

Lead Times and Delivery Schedules

Think about when you actually get the miner. Since most of these machines come from Asia, shipping can take a while. If you order a miner that takes weeks or even months to arrive, you’re missing out on potential earnings during that whole time. This is why some people are willing to pay a bit more for miners that are already closer to home or even ready to go. It’s a trade-off between upfront cost and immediate revenue generation. Planning for these delays is key to managing your expectations and your cash flow.

Spot vs. Future Order Strategies

There are two main ways to buy ASICs: on the spot market or by placing future orders. Spot orders mean you buy what’s available right now. Future orders are for machines that haven’t been made yet, or are just coming off the production line. Ordering in advance often gets you a better price because you’re guaranteeing the manufacturer a sale. However, the big risk here is that manufacturers sometimes delay production. This means your machines might not show up when you expect them, which can mess with your mining plans. It’s a gamble, but sometimes the price savings are worth it. For those looking to scale, understanding how to secure future hardware is important.

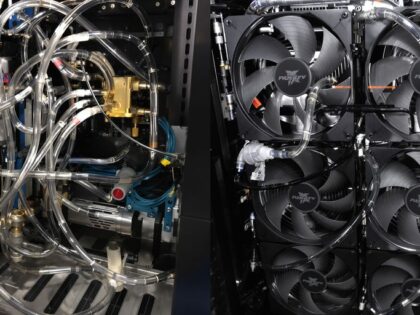

The Role of Cooling Methods

Keeping your ASIC miner cool is super important for it to work its best and not overheat. There are a few ways to do this: air cooling, immersion cooling, and hydro cooling. Air cooling is the most common, but it might not be enough for the hottest environments. Immersion cooling, where the miner is submerged in a special liquid, is much more efficient but also more complex and expensive to set up. Hydro cooling uses water. The best method really depends on how big your operation is, how much you can spend, and what the weather is like where you’re mining. Getting the cooling right means your miners last longer and perform better, directly impacting your profits. Canaan, for example, focuses on optimizing their entire mining process, including sourcing quality machines and competitive power, which ties into efficient operations Canaan’s strategy.

Making the right choices about lead times, how you order, and how you cool your equipment can significantly affect how much money you make. It’s about balancing costs, risks, and the potential for earning.

Factors Influencing ASIC Miner Pricing

When you’re looking to buy ASIC miners, understanding what makes their prices go up and down is pretty important if you want to make a profit. It’s not just about the sticker price; a lot of things play into it, and knowing these can help you snag a better deal and boost your financial freedom.

Impact of Bitcoin Halving on Prices

You’ve probably heard about the Bitcoin halving. This event, which happens roughly every four years, cuts the reward miners get for adding new blocks to the blockchain in half. This directly impacts the profitability of mining, and consequently, the price of ASICs. When rewards get cut, older, less efficient machines can quickly become money-losers. This often leads to a drop in demand and prices for those older models. Newer, more energy-efficient ASICs, however, tend to hold their value better because they can still be profitable even with reduced rewards. It’s a big reason why the market for ASICs can be so volatile.

Decoupling of ASIC Prices from Bitcoin

For a while, ASIC prices pretty much followed Bitcoin’s price. If Bitcoin went up, ASIC prices usually followed. But things have changed. Starting around 2023, ASIC prices started to move differently than Bitcoin. A big reason for this is that there are just way more machines available now, especially on the secondary market. This increased supply, sometimes due to companies going bankrupt or selling off equipment, means that even if Bitcoin’s price is doing well, ASIC prices might not jump up as much as they used to. The halving in 2024 also put pressure on prices because it squeezed profit margins for many miners. So, while Bitcoin’s price is still a factor, it’s not the only thing dictating ASIC costs anymore. You can find more details on this shift by looking at the ASIC Price Index.

The Role of Cooling Methods

Don’t forget about cooling! How a miner is cooled can affect its price and how well it runs. The main ways are air cooling, immersion cooling, and hydro cooling. Each has its pros and cons regarding cost, how much energy it uses, and what kind of setup you need. For example, immersion cooling might cost more upfront for the setup but can help machines run more efficiently and last longer by keeping them at a stable temperature. This efficiency can translate into better long-term profitability, making the initial investment in advanced cooling systems worthwhile for some operations. When you’re comparing miners, think about the cooling system as part of the overall package and its impact on your electricity bill and maintenance needs.

Here’s a quick look at how efficiency is measured:

|

Metric |

Unit |

Description |

|---|---|---|

|

Hashrate |

TH/s |

Computational power (hashes per second) |

|

Power Consumption |

W |

Energy used, impacts electricity costs |

|

Efficiency |

J/TH |

Energy used per terahash (lower is better) |

Remember that the specs manufacturers provide are often based on ideal conditions. Real-world performance can vary based on your environment, like ambient temperature and humidity. Always factor in potential deviations when calculating your expected returns and planning your ASIC mining profitability.

Choosing a Reliable ASIC Miner Supplier

Finding the right supplier for your ASIC mining hardware is a big deal. It’s not just about getting the cheapest price; it’s about getting equipment that actually works, arrives on time, and comes with support if something goes wrong. Think of it like buying a car – you want a reputable dealer, not just anyone with a lot for sale. When you’re looking for reliable asic mining sources, you need to do your homework.

Experience and Professionalism of Suppliers

When you’re talking to potential suppliers, pay attention to how long they’ve been in the game. Companies that have been around for a while, especially those with a good track record, usually know what they’re doing. They understand the market, the equipment, and the logistics involved in getting these machines to you. A supplier with a team that has years of experience in the mining space can offer insights and guidance that you just won’t get from a fly-by-night operation. They should be able to answer your questions clearly and professionally, whether you’re buying one unit or a hundred.

Institutional Procurement Services

If you’re looking to buy a large number of ASICs, you’ll want a supplier that can handle institutional-level orders. This means they have dedicated account executives who can manage the process from start to finish. They should be equipped to deal with bulk purchases, negotiate better terms, and manage the complex shipping and customs procedures that come with large international orders. For example, if you’re looking for an ASIC miner supplier in Fort Lauderdale, you’d want to find one that has experience with both domestic and international logistics to get your equipment to you efficiently.

Supplier Reputation and Customer Service

This is where checking reviews and asking for references really pays off. What do other customers say about their experience? Were the machines delivered as advertised? Was customer service helpful when issues arose? A supplier that prioritizes customer service will be more likely to help you resolve any problems that might come up, whether it’s a faulty unit or a shipping delay. A good supplier will be transparent about lead times and potential issues. It’s also worth looking into companies that have a strong presence and positive feedback within the mining community. For instance, Asic Marketplace is often mentioned as a company that customers find easy to work with and recommend.

Here’s a quick checklist to consider:

-

Years in Business: How long has the company been operating?

-

Customer Reviews: What are people saying online?

-

Support Availability: Can you reach them easily if you have a problem?

-

Transparency: Are they upfront about pricing, shipping, and warranties?

-

Product Knowledge: Do they seem to know their ASICs inside and out?

Getting the right equipment from the right supplier is key to making your mining operation profitable. Don’t rush the decision; take the time to find a partner you can trust to deliver.

Exploring Different ASIC Miner Models

When you’re looking to get into mining, picking the right hardware is a big deal. It’s not just about buying the first thing you see; you need to match the machine to your goals and budget. Think of it like choosing a vehicle – you wouldn’t buy a sports car if you needed to haul lumber, right? The same applies here. Different machines are built for different jobs, and understanding these differences can seriously impact your bottom line.

Popular Bitcoin Mining Hardware

Bitcoin mining is still the big draw for many. When people talk about ASIC miners, they’re often thinking about Bitcoin. The market is pretty dominated by a few big names, with Bitmain’s Antminer series being a common sight. You’ll see models like the Antminer S19 series, which have been workhorses for a while, offering solid hash rates and efficiency. Newer models, like the S21 series, push the boundaries even further, giving you more processing power per watt. Choosing a high hash rate miner is key for maximizing your Bitcoin earnings. It’s all about getting the most hashes done in the shortest amount of time to solve those complex equations and earn rewards. For a look at some top contenders, you might want to check out top ASIC miners for 2025.

Miners for Other Cryptocurrencies

But it’s not all about Bitcoin. Plenty of other cryptocurrencies use mining, and they often require different types of ASICs. For example, if you’re interested in Dogecoin, you’ll be looking at machines designed for that specific algorithm, like some of the iBeLink or Goldshell models. Similarly, for Ethereum Classic, you’ll find Jasminer and iPollo offering specialized hardware. It’s important to know which coin you want to mine because the ASIC you need for Bitcoin won’t work for Dogecoin, and vice versa. This specialization is what makes ASIC miners so efficient for their intended purpose.

Energy Efficiency and Hash Rates

When you’re comparing miners, two numbers always pop up: hash rate and energy efficiency. The hash rate tells you how fast the machine can perform calculations – more hashes per second (TH/s for Bitcoin, GH/s for others) generally means more potential earnings. But you can’t ignore energy efficiency, usually measured in Joules per Terahash (J/TH) or similar units. A miner that’s super powerful but uses a ton of electricity might not be as profitable if your electricity costs are high. It’s a balancing act. You want a machine that gives you a great hash rate without costing you a fortune in power bills. For instance, some of the latest Bitcoin mining hardware in Europe offers impressive performance metrics, so it’s worth looking into specific models for your region.

Finding the right balance between raw power and energy consumption is the secret sauce to profitable mining. Don’t get blinded by just one number; look at the whole picture.

Here’s a quick look at how some popular models stack up:

|

Miner Model |

Primary Coin |

Hash Rate (Approx.) |

Energy Efficiency (Approx.) |

|---|---|---|---|

|

Bitmain Antminer S21 |

Bitcoin |

200-230 TH/s |

20 J/TH |

|

Goldshell DG Max |

Dogecoin |

6.5 GH/s |

32 J/GH |

|

Jasminer X16-P |

ETC |

5800 MH/s |

20 J/MH |

Remember, these figures can change, and actual performance depends on many factors, including your setup and electricity costs. Always do your own research before buying.

Thinking about getting into ASIC mining? There are tons of different machines out there, each with its own strengths. Some are super powerful, while others are more energy-efficient. It’s a big decision, and understanding the options is key to making a smart choice for your mining setup. Want to dive deeper into the world of ASIC miners and find the perfect fit for you? Visit our website today to explore all the latest models and get the information you need!

Wrapping Up Your ASIC Search

So, you’ve looked into different brands like Bitmain and MicroBT, checked out new versus used machines, and thought about warranties and lead times. It’s a lot to take in, for sure. Finding the right ASIC miner supplier means doing your homework and making sure the deal makes sense for you. Don’t rush into anything; compare prices, ask questions, and maybe even talk to other miners about their experiences. Getting the right equipment is the first big step in this whole mining adventure.

Frequently Asked Questions

What exactly is an ASIC miner?

ASIC miners are special computers built to do one thing: mine cryptocurrencies like Bitcoin. They are super fast and use less power than regular computers for mining, making them the best choice for serious miners.

Who makes the most ASIC miners?

Bitmain (Antminer) is the biggest maker, with MicroBT (Whatsminer) and Canaan (Avalon) also being major players. Most of these companies are based in China, but some also build their machines in other places like the US.

What should I check when buying a used ASIC miner?

When buying a used ASIC, always ask for a ‘hash report.’ This shows how well it’s working and how much power it uses. It helps you know if it has problems like bad fans or chips that could slow it down.

What’s usually covered by an ASIC miner’s warranty?

Most new ASICs come with a 1-year warranty. This warranty usually doesn’t cover machines that are older than a year, or if you’ve messed with the machine’s settings, changed parts, or used it in a way it wasn’t meant for, like putting an air-cooled one in liquid.

How do prices for ASIC miners get decided?

Prices can change a lot! Sometimes, big events like the Bitcoin ‘halving’ affect prices. Also, the price of an ASIC doesn’t always go up or down exactly with the price of Bitcoin. Buying in bulk can sometimes get you a better deal.

What’s the difference between spot and future orders for ASICs?

Getting your miners can take time, especially if they’re made far away. Some people buy ‘future orders’ to lock in prices for upcoming machines, but this means waiting. Others prefer to buy ‘spot orders’ for machines that are ready to go, even if they cost a bit more.